Mutual Funds Explained:

A Smart Gateway for Everyday Investors

Author: Ratender Singh Dhull

In a financial world flooded with opinions, tips, and noise, trust has become a rare commodity. Yet despite constant change in markets and technology, mutual funds have quietly remained one of the most reliable ways for everyday investors to participate in wealth creation.

They don’t promise overnight riches. What they offer instead is balanced professional management, built-in diversification, and accessibility without the pressure of constant decision-making. For investors in their 20s and early 30s, this makes mutual funds one of the most sensible entry points into financial markets.

What Is a Mutual Fund?

At its core, a mutual fund is a professionally managed investment vehicle that pools money from multiple investors and deploys it across a diversified portfolio. These portfolios typically include equities, fixed-income instruments, or a carefully structured mix of both.

Instead of selecting individual securities, investors gain exposure to broader markets through experienced portfolio managers who actively manage holdings in line with the fund’s objective, supported by research teams and regulatory oversight.

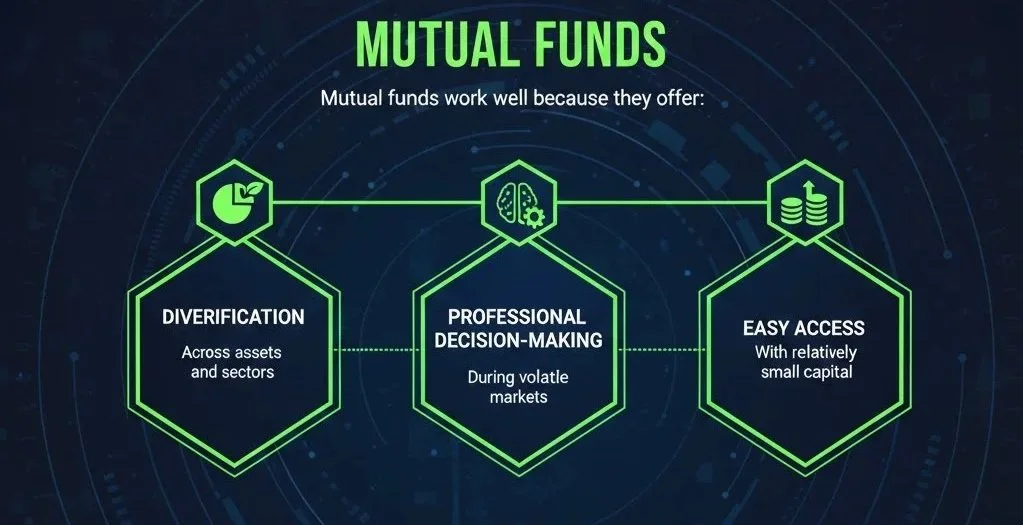

Why Mutual Funds Continue to Work

One of the biggest challenges for new investors is managing risk, especially the risk of putting too much faith in a single stock or market idea. Mutual funds reduce this exposure by spreading investments across multiple assets, sectors, and market capitalisations.

They also remove much of the emotional strain associated with investing. Instead of reacting to daily market swings, investors rely on professionals trained to navigate volatility across cycles. Combined with low entry barriers, mutual funds encourage consistency and discipline.

Mutual funds work well because they offer:

Diversification across assets and sectors

Professional decision-making during volatile markets

Easy access with relatively small capital

How Do Mutual Funds Generate Returns?

Mutual funds generate returns through a combination of income, realised gains, and long-term appreciation. Investors may receive dividends or interest from the securities held in the fund, benefit from capital gains when assets are sold at a profit, and see growth as the overall portfolio value increases over time.

Returns typically come from:

Dividends or interest income

Capital gains on asset sales

Appreciation of the fund’s Net Asset Value (NAV)

This layered structure allows investors to participate in market growth without needing to predict short-term price movements.

Inside the Mutual Fund Engine

Behind the scenes, mutual funds operate within a tightly regulated framework. Portfolio managers make allocation decisions based on research and market conditions, while analysts evaluate companies, sectors, and macroeconomic trends.

A typical mutual fund ecosystem includes:

Portfolio managers overseeing asset allocation

Research analysts supporting investment decisions

Compliance teams ensure regulatory adherence

Fund accountants calculating daily NAVs

Many of the world’s most trusted funds are managed by global investment houses such as Vanguard, Fidelity, and BlackRock.

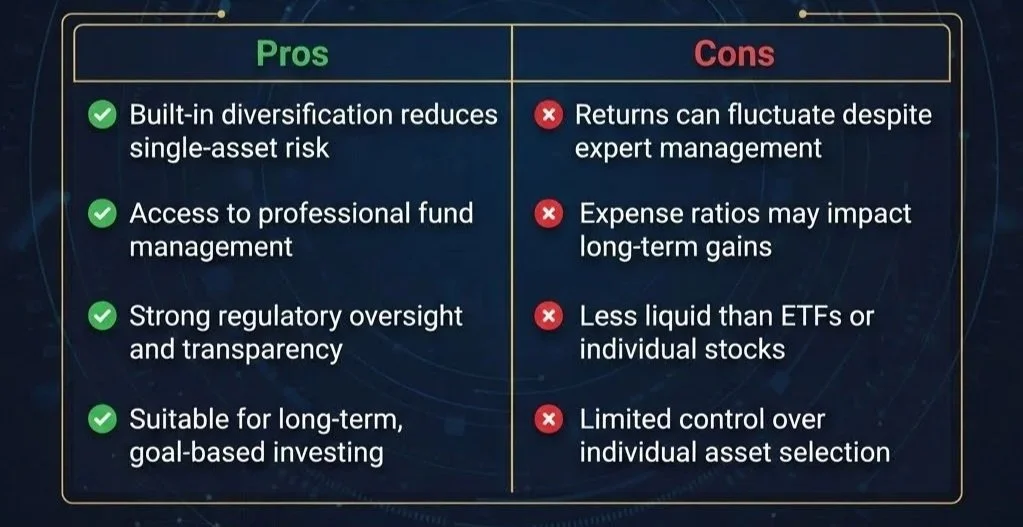

Fees: Understanding the Trade-Off

Mutual funds charge an annual expense ratio (generally between 1% and 3%) covering management, research, and operations. Some funds may also apply exit loads to discourage short-term withdrawals.

While fees do impact net returns, they support the professional systems that provide governance, transparency, and risk control, all critical for long-term investing.

Pros and Cons of Mutual Funds

Like any financial product, mutual funds come with strengths and limitations. Understanding both helps investors set realistic expectations.

Mutual Funds vs ETFs: Active vs Passive Investing

Mutual funds are actively managed, meaning portfolio managers adjust holdings in response to research insights and changing market conditions. ETFs, by contrast, are typically passively managed and track indices at lower cost.

In simple terms:

Mutual funds suit investors seeking professional oversight

ETFs suit investors preferring low-cost, self-directed exposure

Both play important roles depending on investor goals and experience.

Why Mutual Funds Matter for Aspiring Traders

For those looking to move beyond investing into trading or capital markets, mutual funds provide a strong conceptual foundation. They introduce ideas such as portfolio construction, diversification logic, and risk-adjusted returns, principles that underpin professional trading strategies.

Understanding how institutions allocate capital across cycles is essential before stepping into more active market participation.

From Investing to Trading: Why Derivion Matters

While mutual funds are ideal for building long-term exposure, trading demands deeper insight into market structure, price behaviour, and risk management. Making this transition responsibly requires structured education.

Derivion’s Applied Trading & Advanced Capital Markets Programme bridges this gap by combining:

Capital markets theory

Live trading exposure

Institutional risk management frameworks

Under the guidance of experienced market professionals, participants develop disciplined approaches to market analysis, trade execution, and capital preservation - focusing on repeatable, institution-grade trading processes rather than short-term speculation.

Final Thoughts

Mutual funds remain a powerful gateway into financial markets, offering diversification, professional oversight, and consistency, especially valuable for investors in their 20s and early 30s.

For those who wish to progress into trading or capital markets, this foundation becomes even more relevant. With the right education and structure, investing evolves into informed and confident market participation.